April 4, 2021 SCRP WA State Legislative Update

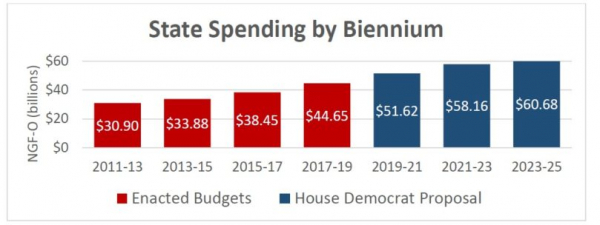

A proposed $58.2 billion operating budget proposal that passed the House yesterday increases spending by nearly 13 % over the current biennial budget, and relies on an income tax on capital gains, which is likely unconstitutional and completely unnecessary.

The measure passed 57-41 on a party line vote.

Following passage, LD 20 House Rep. Abbarno issued this statement:

“The level of state spending this year is irresponsible and reckless. The budget approved by House Democrats relies on unnecessary tax increases, including a new unneeded, unpopular, and unconstitutional capital gains tax. State revenue is sufficient to support the budget spending without the tax increases.

“The House Democrat operating budget reflects a very dangerous and insatiable appetite for tax increases at a time when the state has sufficient revenue to fund the proposed expenditures. It is bad enough that the operating budget creates unsustainable programs, but the tax increases and budget gimmicks add insult to injury. There are some good things in this budget that should be funded and could be funded without increasing the tax burden.”

Abbarno noted the following concerns about the operating budget proposal that passed the House on Saturday (April 3):

State spending has increased rapidly in recent years and this budget is no exception. It would grow state spending by $6.6 billion, an increase of 12.8% over the current budget cycle.

State spending has increased by 72% since Gov. Inslee entered office in 2013.

This past year, state tax collections grew by 10%, making tax increases unnecessary to fund the proposed budget.

Roughly $24 billion in federal stimulus funds will be provided to state and local governments.

Capital gains income tax is unnecessary, likely unconstitutional, and unpopular among Washington citizens. Washingtonians have told us several times they do not want any form of a state income tax, defeating such proposals by overwhelming margins. In 2010, Initiative 1098 was defeated by 28 points.

A January Crosscut/Elway poll showed that 54% of Washingtonians “definitely oppose” or “probably oppose” a tax on capital gains.

Gov. Inslee’s emergency powers over COVID have gone unchecked long enough | Editorial

Share This Post...